Economist’s Corner – New Jersey’s Small Business Landscape

As we head into Small Business Saturday, the charts below help us understand COVID-19’s impact on small businesses, a sector of the New Jersey economy that has been hit especially hard by the pandemic. The good news for local small businesses is that COVID-19 presents a double-edged sword in terms of local spending. The pandemic has created challenges for small businesses, but it has also caused most NJ residents to stay close to home and enticed new residents into the state, which means a larger portion of these residents’ consumer dollars are also staying closer to home and supporting local businesses. In addition, the New Jersey Economic Development Authority (NJEDA) has created new programs to provide small businesses with much-needed financial support and technical assistance to help get them through these rough times.

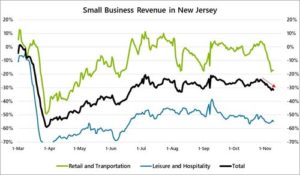

Indicator 1 – Small Business Revenue

Source: Opportunity Insights Economic Tracker

This first economic indicator shows New Jersey small business revenue for all industries and revenue broken out by two specific areas of industry: retail and transportation, and leisure and hospitality. Here, small businesses are defined as businesses with annual revenue below U.S. Small Business Administration thresholds[1]. The chart depicts changes in revenue relative to where it was right before COVID-19 arrived in New Jersey to give a picture of how small business revenue has been impacted by the pandemic.

There are a few readily apparent narratives illustrated in the chart. One is that small business revenue has taken a huge hit. As of the first week of November, small business revenue was down more than 30 percent relative to January. This revenue decline actually represents a significant recovery from the depths of the economic shutdown, when revenue was down nearly 60 percent. But after recovering a good portion of lost revenue through the summer, small business revenue levels have been relatively stagnant, signaling a lack of momentum in the small business economy. The chart also shows that, as the COVID-19 new case rate has risen back to levels seen in April, small business revenue is suffering another downturn. Since late October, small business revenue has deteriorated from around -24 percent to -32 percent.

A third and clearly apparent narrative is that COVID-19 has had differential impacts on several industries. For instance, the pandemic has had an especially large impact on the leisure and hospitality industry, where revenues are down more than 50 percent, while in retail and transportation, revenue had essentially recovered to pre-COVID levels. Unfortunately, as virus cases are rising sharply, retail and transportation revenue is again declining sharply.

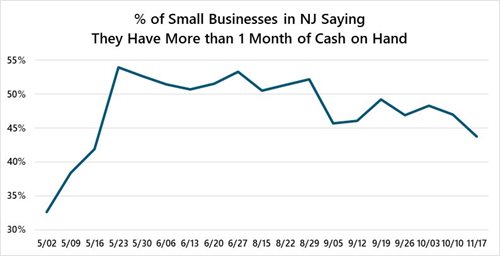

Indicator 2 – Cash on Hand

Source: US Census Bureau

In the context of this latest surge in virus cases, it is important to consider the breadth of small business cash levels as indication of how prepared these businesses are to weather another demand decline. This chart shows the percentage of small businesses that report having cash levels that can cover one month or more of expenses. The data is pulled from the Small Business Pulse, which is a survey that measures the effect of changing business conditions during the pandemic on small businesses.

As the chart shows, coming into May, a little more than 30 percent of small businesses in New Jersey reported having cash levels to cover a month or more of expenses. Then, as the Paycheck Protection Program (PPP) provided much needed cash to small businesses, cash levels improved markedly. According to the survey, approximately 70 percent of New Jersey small businesses received PPP loans. At its high point, almost 55 percent of small businesses reported having cash levels to cover one month or more of expenses. But as PPP becomes more of a distant memory, cash levels have deteriorated. In the latest weekly survey, only 43 percent of small businesses reported having one month or more of cash in reserve. And as COVID cases are on the rise and activity slows, we’re almost certain to see cash levels deteriorate further. This will create a pressing need for additional funding support for small businesses. At the time of this publication, the NJEDA in 2020 had approved over $150 million in grants to New Jersey’s small businesses, of which over $85 million were approved since the beginning of November. This recent surge in funds will help provide much needed resources to the small business community.

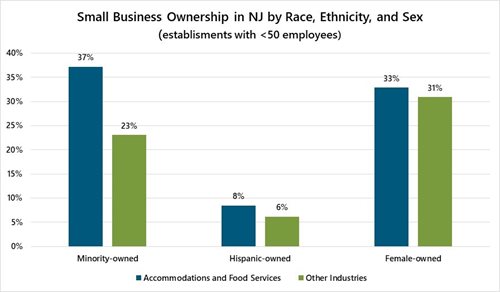

Indicator 3 – Small Business Ownership by Race, Ethnicity, and Sex

Source: US Census Bureau

Small Businesses provide significant economic opportunities to more economically marginalized groups. These businesses are more likely to be minority- or woman-owned than larger businesses, which means the drop in small business activity has had an outsized economic impact on minorities and women. This is especially true in the accommodations and food services industries, where significantly higher shares of businesses are minority- and woman-owned (approximately 37 percent and 33 percent respectively). Unfortunately, accommodations and food services has been amongst the hardest hit industries, with revenue down more than 50 percent from pre-pandemic levels. This has an outsize impact on historically marginalized groups and creates an even more pressing need for economic assistance that specifically supports these communities. Once again, the NJEDA has been working to help these communities. Of the over $150 million in grants approved this year, approximately 24 percent has been to minority-owned businesses, 26 percent to women-owned businesses, and 30 percent to small businesses in opportunity zones. Note these are non-mutually exclusive shares that have a significant amount of overlap.

[1] https://www.sba.gov/sites/default/files/2019-08/SBA%20Table%20of%20Size%20Standards_Effective%20Aug%2019%2C%202019_Rev.pdf

Related Content

December 20, 2024

NJ Motion Picture & TV Commission Extends Public Comment Period for Updated Film Ready New Jersey Program Requirements

TRENTON, N.J. (December 20, 2024) – The New Jersey Motion Picture and Television Commission (NJMPTVC), under the New Jersey Economic Development Authority (NJEDA), is extending the open public comment period for amendments to the Commission’s Film Ready New Jersey Program requirements until Friday, January 3, 2025.

December 19, 2024

Netflix Studio Project Approved for Aspire Tax Credits by NJEDA Board

TRENTON, N.J. (December 19, 2024) – The New Jersey Economic Development Authority (NJEDA) Board today approved Aspire tax credits for the Netflix Studio at Fort Monmouth.

December 18, 2024

ResearchwithNJ Portal Gives Entrepreneurs and Investors Free Access to Research at New Jersey’s World-Class Universities

TRENTON, N.J. (December 18, 2024) – The New Jersey Commission on Science, Innovation and Technology (CSIT) today announced the expansion of the website for ResearchwithNJ from five to eight leading research institutions, resulting in more than 365,000 pieces of research output and close to 7,000 researcher profiles.