FILM AND DIGITAL MEDIA TAX CREDIT PROGRAM

For the full New Jersey Motion Picture and Film Commission website, please visit

NJ DOS – NJ Motion Picture & Television Commission.

Provides a transferable credit against the corporation business tax and the gross income tax for qualified expenses incurred for the production of certain film and digital media content in New Jersey.

The goal of the program is to incentivize production companies to film and create digital media content in New Jersey.“For the full New Jersey Motion Picture and Film Commission website, please visit NJ DOS – NJ Motion Picture & Television Commission.

Available tax credits up to 40 % for film

and digital media productions.

Tax credit up to 35 percent of qualified film production expenses

NOTE:

Qualified film production expenses incurred for services performed and tangible personal property purchased for use at a sound stage or other location that is located in the State within a 30-mile radius of the intersection of Eighth Avenue/Central Park West, Broadway, and West 59th Street/Central Park South, New York, New York are eligible for 30 percent.

APPLICATION

- New Film Tax Credit Online Application

- Application Checklist

- Frequently Asked Questions

- Project Synopsis Form

- NEW* Agreed Upon Procedures for CPA Verification Report

- Agreed Upon Procedures for CPA Verification Report

- Form A – Diversity Plan

- Form B – Diversity Tracking Sheet – To be used in conjunction with Diversity Goal Tracker if payroll information cannot be provided.

- Diversity Goal Tracker

- Detailed Film Production Budget Form

- Film Tax Credit Transfer Application

NOTE: Tax credits are available on a first-come, first-served basis, based on the date/time a fully completed application is received by the NJEDA. If an incomplete application is received, the NJEDA will notify the applicant, who will be required to provide the additional information and re-submit the application. In this scenario, the date/time of record will be based upon when the complete application is resubmitted, not the initial submittal of the incomplete application.

ELIGIBILTY

In order for a film project to be eligible for tax credits under the NJ Film Tax Credit Program, the film project must:

- Be a feature film, a television series, or a television show of 22 minutes or more in length, intended for a national audience, or a television series or a television show of 22 minutes or more in length intended for a national or regional audience, including, but not limited to, a game show, award show, or other gala event filmed and produced at a nonprofit arts and cultural venue receiving State funding. Productions featuring news, current events, weather, and market reports or public programming, sports event, a production that solicits funds, a production containing obscene material as defined under N.J.S.2C:34-2 and N.J.S.2C:34-3, or a production primarily for private, industrial, corporate, or institutional purposes are not eligible for film tax credits. Reality Shows are ineligible unless the production has obtained a six-episode order from, and is commissioned and scheduled to premiere on, a major linear network or streaming service. Meet one of the following expense eligibility thresholds:

- Meet one of the following expense eligibility thresholds:

60 percent of the total film production expenses (exclusive of post -production costs) must be incurred for services and goods purchased through vendors authorized to do business in New Jersey.

Qualified film production expenses (expenses incurred in New Jersey for the production of a film) must exceed $1 million per production.

- End credits must include “Filmed in New Jersey” statement or logo.

- Principal photography of the project must commence within 180 days of application.

- “Reality shows”, which are otherwise ineligible, may be eligible for the Film Tax Credit Program if at least 60 percent of the total film production expenses (exclusive of post-production costs) are incurred for services and good purchased through vendors authorized to do business in New Jersey, and the qualified film production expenses for the show exceed $1 million per production.

FEES

Application Fee:

| Project Tiers (Qualified Spend) | ||

| Micro/ Indie | $ – | $ 999,999 |

| Small | $ 1,000,000 | $ 5,999,999 |

| Medium | $ 6,000,000 | $ 14,999,999 |

| Large | $ 15,000,000 | $ 29,999,999 |

| Mega | $ 30,000,000 | |

| Tier | Application Fee | Approval Fee | Issuance Fee | Credit Transfer Fee (Per Transfer) |

| Micro/Indie | $ 100 | $ 100 | $ 100 | $ 1,000 |

| Small | $ 250 | $ 500 | $ 500 | $ 5,000 |

| Medium | $ 2,000 | $ 5,000 | $ 5,000 | $ 5,000 |

| Large | $ 5,000 | $ 12,000 | $ 12,000 | $ 5,000 |

| Mega | $ 10,000 | $ 25,000 | $ 25,000 | $ 5,000 |

All fee tiers are based on each application’s qualified film production expenses. The fee tier then sets each fee amount.

Application Fees are non-refundable and due at application submission.

Approval Fees are non-refundable (unless the project is declined) and due prior to project approval

Issuance Fees are non-refundable and due prior to tax credit issuance.

Credit Transfer Fees are non-refundable and due at tax credit transfer application submission and are per transfer.

*Each project is also subject to a non-refundable 3rd party budget review fee due prior to project approval.

*Application fees are subject to change if submitted budget amounts change prior to approval.

The primary objective of the 2-4% Diversity Tax Credit is to stimulate job growth by encouraging film productions to employ the services of women and minority persons. The structure of this program seeks to further ensure that equal employment opportunities are offered to “above-the-line” positions (generally, key creative positions) as well as “below-the-line” positions (all other production crew).

Film productions looking to receive a diversity bonus can be awarded either 2% or 4% of the qualified film production expenses. See c) below to learn the difference in requirements for each increase.

Requirements:

(a) An applicant that seeks to increase its award through the use of a diversity plan shall submit a completed plan (see Form A – Diversity Plan) to NJEDA before the NJEDA may approve an application pursuant to the applicable program rules. An applicant may consult with the NJEDA regarding the requirements of the diversity plan in advance of submitting the plan.

(b) The diversity plan shall identify that the applicant intends to prioritize actively recruiting and hiring African Americans, Hispanic, Asian Americans, Native Americans, and women in all areas of production of the film, specifically production crew and staff, entry level positions, management positions and talent related positions.

(c) An overall goal of not less than 25 percent shall be utilized in the hiring of minority persons and women. All diversity plans must identify goals for hiring both minority persons and women.

– To receive a bonus of 2%: no less than 25% of the total employees hired must be women or members of a minority group

– To receive a bonus of 4%: above requirement must be met AND no less than 25% of the onscreen talent must be 1. women or members of a minority group; 2. Residents of NJ for at least 12 months before the beginning of filming; and 3. Are members of a bona fide labor union representing film and television performers

(d) The diversity plan will indicate whether and, if so, how the applicant intends to participate in training, education and recruitment programs that are organized in cooperation with New Jersey state colleges and universities, labor organizations, and the motion picture industry and are designed to promote and encourage the training and hiring of New Jersey residents who represent the diversity of the state’s population. Such cooperation is encouraged but not required.

(e) The diversity plan shall indicate which efforts the applicant will make to ensure equal employment opportunities for minority persons and women in the recruitment, selection, appointment, promotion, training, and related employment areas. These actions may include advertising, recruitment, and internship opportunities

Program Reporting:

If as part of the final documentation required for final approval of the tax credit, the applicant submits evidence satisfactory to the NJEDA and the Director of the Division of Taxation of good faith-efforts to accomplish all the actions described in the diversity plan, the final tax credit amount will include the bonus. If the final approval of the applicant’s tax credit application does not include the bonus, the applicant may appeal the final approval as described in the program rules at N.J.A.C. 19:31-21.7(f).

Certification:

In order to support the fact that an individual who worked on the production is a woman or minority person, consistent with the applicable rules, the applicant must provide payroll information detailing which individuals working on the production self-identified as either minority and/or woman, or provide the Authority with a copy of the Diversity Tracking Sheet, (see Form B – Diversity Tracking Sheet) from the individual, if the information is not available from the payroll company.

Good Faith:

The applicant shall undertake appropriate outreach and talent acquisition activities that are reasonably designed to effectively identify, recruit and incorporate women and minority persons into the applicable film production. Good faith efforts are assessed using various factors, including, but not limited to the following, which shall be provided by the applicant:

– A report prepared by the payroll company or the diversity employment tracker (if payroll information is not available) listing the applicant’s overall number of production workers, by category, upon completion of filming.

– The names, addresses, and other information provided on the payroll information or on the Diversity Tracking Sheets of minority and women production workers, by category, upon completion of filming.

– The final diversity numbers of the production.

– Documentation of efforts made to recruit and hire women and minority persons to meet the goals of the diversity plan. This can include, casting solicitations, e-mail confirmation or other correspondence to those people contacted but not hired. A list of names, dates and times of people and/or businesses that were contacted may be considered as well.

– The NJEDA may contact the individuals and businesses listed by the applicant to verify the good faith efforts.

Audit Process:

NJEDA or the Division of Taxation may audit the applicant’s submissions, in which case the NJEDA or the Division of Taxation may ask for documents supporting the application and submitted documentation regarding the diversity plan, including, but not limited to, any of the following documents:

– the books, records and supporting documents of the eligible production corporation

– agreements and contracts between actors, producers, directors, and other persons and the eligible production corporation

– any other documents that may be needed to support your claim

– Form B – Diversity Tracking Sheet – To be used in conjunction with Diversity Goal Tracker if payroll information cannot be provided.

NOTE: Tax credits are available on a first-come, first-served basis, based on the date/time a fully completed application is received by the NJEDA. If an incomplete application is received, the NJEDA will notify the applicant, who will be required to provide the additional information and re-submit the application. In this scenario, the date/time of record will be based upon when the complete application is resubmitted, not the initial submittal of the incomplete application.

Pursuant to PL 2018 c.56, principal photography must begin within 180 days of a complete application.

Projects utilizing NJEDA financial assistance for construction related costs are subject to state prevailing wage requirements.

Effective April 1, 2020 all construction contracts in which prevailing wage applies must provide proof of valid NJ Department of Labor Construction Registration Certification. Please email PWCR@dol.nj.gov if you have any questions about this requirement. Please be advised that a valid Contractor Registration Certificate is required to perform construction on this NJEDA financially assisted project.

Film Incentive Transparency Map

Please be advised: New Jersey State law prohibits most cannabis license and certification holders from receiving or continuing to receive an economic incentive from the NJEDA. If the applicant, or any person who controls the applicant or owns or controls more than one percent of the stock of the applicant, has applied for or received a license or a certification from the New Jersey Cannabis Regulatory Commission (NJ-CRC), the applicant is ineligible for this program and should not proceed with an application. If an application is received from an applicant that meets this criteria, the application will be declined and the application fee will not be refunded.

Tax credit equal to 30 percent of qualified digital media production expenses, or 35 percent of qualified digital media production expenses incurred for services performed and tangible personal property purchased through vendors whose primary place of business is located in Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Mercer or Salem County.

Additional incentives are offered for post-production in the form of a tax credit equal to 35% of the qualified digital media content production expenses incurred for post-production services including visual effects services performed by a qualified independent post-production company, or 40% of qualified digital media production expenses for post-production services performed at a New Jersey film-lease production facility or that are incurred by a New Jersey studio partner.

APPLICATION

Applications for the digital media post-production credit are not available yet.

NOTE: Tax credits are available on a first-come, first-served basis, based on the date/time a fully completed application is received by the NJEDA. If an incomplete application is received, the NJEDA will notify the applicant, who will be required to provide the additional information and re-submit the application. In this scenario, the date/time of record will be based upon when the complete application is resubmitted, not the initial submittal of the incomplete application

ELIGIBILITY

Digital Media Tax Credit

To be eligible for tax credits, digital media applications (non-post-production) must meet two thresholds:

- At least $2 million of the total digital spend must be incurred through authorized New Jersey vendors (excluding wage and salary payments to employees) AND

- 50% of the qualified digital expenditures must be for wages and salary expenses paid to full-time workers in New Jersey who work on digital media.

Digital Media Tax Credit (Post-Production)

For a film to be eligible for tax credits under the NJ Digital Media Post-Production Tax Credit Program, at least $500,000 of the total digital media content post-production expenses are incurred for post-production services- including visual effects services- performed at a film-lease production facility, performed by a studio partner, or incurred through a qualified independent post-production house. A project does not need to be filmed in New Jersey to receive this credit so long as the post-production services are performed in New Jersey.

FEES

Application Fee:

| Project Tiers (Qualified Spend) | ||

| Micro/ Indie | $ – | $ 999,999 |

| Small | $ 1,000,000 | $ 5,999,999 |

| Medium | $ 6,000,000 | $ 14,999,999 |

| Large | $ 15,000,000 | $ 29,999,999 |

| Mega | $ 30,000,000 | |

| Tier | Application Fee | Approval Fee | Issuance Fee | Credit Transfer Fee (Per Transfer) |

| Micro/Indie | $ 100 | $ 100 | $ 100 | $ 1,000 |

| Small | $ 250 | $ 500 | $ 500 | $ 5,000 |

| Medium | $ 2,000 | $ 5,000 | $ 5,000 | $ 5,000 |

| Large | $ 5,000 | $ 12,000 | $ 12,000 | $ 5,000 |

| Mega | $ 10,000 | $ 25,000 | $ 25,000 | $ 5,000 |

All fee tiers are based on each application’s qualified film production expenses. The fee tier then sets each fee amount.

Application Fees are non-refundable and due at application submission.

Approval Fees are non-refundable (unless the project is declined) and due prior to project approval

Issuance Fees are non-refundable and due prior to tax credit issuance.

Credit Transfer Fees are non-refundable and due at tax credit transfer application submission and are per transfer.

*Each project is also subject to a non-refundable 3rd party budget review fee due prior to project approval.

*Application fees are subject to change if submitted budget amounts change prior to approval.

The primary objective of the 4% Diversity Tax Credit is to stimulate job growth by encouraging film productions to employ the services of women and minority persons. The structure of this program seeks to further ensure that equal employment opportunities are offered to “above-the-line” positions (generally, key creative positions) as well as “below-the-line” positions (all other production crew).

Requirements:

(a) An applicant that seeks to increase its award through the use of a diversity plan shall submit a completed plan (see Form A – Diversity Plan) to NJEDA before the NJEDA may approve an application pursuant to the applicable program rules. An applicant may consult with the NJEDA regarding the requirements of the diversity plan in advance of submitting the plan.

(b) The diversity plan shall identify that the applicant intends to prioritize actively recruiting and hiring African Americans, Hispanic, Asian Americans, Native Americans, and women in all areas of production of the film, specifically production crew and staff, entry level positions, management positions and talent related positions.

(c) An overall goal of not less than 25 percent shall be utilized in the hiring of minority persons and women. All diversity plans must identify goals for hiring both minority persons and women.

(d) The diversity plan will indicate whether and, if so, how the applicant intends to participate in training, education and recruitment programs that are organized in cooperation with New Jersey state colleges and universities, labor organizations, and the motion picture industry and are designed to promote and encourage the training and hiring of New Jersey residents who represent the diversity of the state’s population. Such cooperation is encouraged but not required.

(e) The diversity plan shall indicate which efforts the applicant will make to ensure equal employment opportunities for minority persons and women in the recruitment, selection, appointment, promotion, training, and related employment areas. These actions may include advertising, recruitment, and internship opportunities

Program Reporting:

If as part of the final documentation required for final approval of the tax credit, the applicant submits evidence satisfactory to the NJEDA and the Director of the Division of Taxation of good faith-efforts to accomplish all the actions described in the diversity plan, the final tax credit amount will include the bonus. If the final approval of the applicant’s tax credit application does not include the bonus, the applicant may appeal the final approval as described in the program rules at N.J.A.C. 19:31-21.7(f).

Certification:

In order to support the fact that an individual who worked on the production is a woman or minority person, consistent with the applicable rules, the applicant must provide payroll information detailing which individuals working on the production self-identified as either minority and/or woman, or provide the Authority with a copy of the Diversity Tracking Sheet, (see Form B – Diversity Tracking Sheet) from the individual, if the information is not available from the payroll company.

Good Faith:

The applicant shall undertake appropriate outreach and talent acquisition activities that are reasonably designed to effectively identify, recruit and incorporate women and minority persons into the applicable film production. Good faith efforts are assessed using various factors, including, but not limited to the following, which shall be provided by the applicant:

- A report prepared by the payroll company or the diversity employment tracker (if payroll information is not available) listing the applicant’s overall number of production workers, by category, upon completion of filming.

- The names, addresses, and other information provided on the payroll information or on the Diversity Tracking Sheets of minority and women production workers, by category, upon completion of filming.

- The final diversity numbers of the production.

- Documentation of efforts made to recruit and hire women and minority persons to meet the goals of the diversity plan. This can include, casting solicitations, e-mail confirmation or other correspondence to those people contacted but not hired. A list of names, dates and times of people and/or businesses that were contacted may be considered as well.

- The NJEDA may contact the individuals and businesses listed by the applicant to verify the good faith efforts.

Audit Process:

NJEDA or the Division of Taxation may audit the applicant’s submissions, in which case the NJEDA or the Division of Taxation may ask for documents supporting the application and submitted documentation regarding the diversity plan, including, but not limited to, any of the following documents:

- the books, records and supporting documents of the eligible production corporation

- agreements and contracts between actors, producers, directors, and other persons and the eligible production corporation

- any other documents that may be needed to support your claim

- Form A – Diversity Plan

- Form B – Diversity Tracking Sheet – To be used in conjunction with Diversity Goal Tracker if payroll information cannot be provided.

NOTE: Tax credits are available on a first-come, first-served basis, based on the date/time a fully completed application is received by the NJEDA. If an incomplete application is received, the NJEDA will notify the applicant, who will be required to provide the additional information and re-submit the application. In this scenario, the date/time of record will be based upon when the complete application is resubmitted, not the initial submittal of the incomplete application.

Projects utilizing NJEDA financial assistance for construction related costs are subject to state prevailing wage requirements.

Effective April 1, 2020 all construction contracts in which prevailing wage applies must provide proof of valid NJ Department of Labor Construction Registration Certification. Please email PWCR@dol.nj.gov if you have any questions about this requirement. Please be advised that a valid Contractor Registration Certificate is required to perform construction on this NJEDA financially assisted project.

STUDIO AND FILM-LEASE PARTNER

To encourage the development of large, long term studio facilities, two additional and separate allocation designations were created by the Economic Recovery Act of 2020, one for Studio Partners and one for Film-lease Partners.

Studio Partners would first apply to the Authority for the designation and then submit subsequent applications for each film project produced in New Jersey thereafter.

Projects submitted by a studio partner or film-lease production company will be calculated at 35-40% based on certain qualified production expenses. The studio partner and film-lease production company projects have their own approval queue and annual allocation of $150M per fiscal year.

Studio Partner

To be eligible to apply for the Studio Partner designation, the applicant must be a production company that has site control of a production facility that is at least 250,000 sqft for at least 10 years.

Prior to approval, the production facility site would need to have at least preliminary site plan approval, an executed redevelopment agreement, or an adopted redevelopment plan that contemplates the construction of the production facility and following designation approval, be able to provide temporary or permeant certificate of occupancy for the facility within 48 months.

Depending on the amount of qualified film production expenses involved in each submitted project, a Studio Partner is able to capture additional Above-the-line(ATL) wage and salary expenses in its award calculation as follows:

- For a studio partner that incurs less than $25 million in qualified film production expenses, they can include up to $18 million in ATL wage and salary expenses as qualified per project.

- For a studio partner that incurs $25 million or more in qualified film production expenses, they can include up to $72 million in ATL wage and salary expenses as qualified per project.

No more than 3 designations can be made for studio partners.

Film-Lease Partner Facility Designation

To be eligible for the Film-Lease Production Facility designation, the applicant must be an owner or developer who commits or own, lease, or operate a production facility of at least 250,000 sqft for a period of 5 or more successive years.

The owner or developer of the facility will partner with the EDA and shall accept an equity investment in the project from the EDA, at the EDA’s discretion, as a condition of approval for the Film-lease Partner Facility designation.

There are no direct film tax credits available with a film-lease partner facility designation. However, the designation would allow certain production companies who use the facility to received higher award amounts under the program. No more than 3 designations can be made for film-lease partner facilities.

Film-Lease Production Company

To be eligible for the Film-Lease Production company designation, the applicant must be a production company who commits to lease or otherwise occupy production space within a Film-lease Production Facility.

To receive the credit, film-lease production companies must satisfy one of the following two criteria:

- The film production company film at least 50% of the total principal photography days of the project within New Jersey at the New Jersey film-lease partner facility; OR

- The qualified film production expenses of the project for all services performed and goods used or consumed at the New Jersey film-lease partner facility must be equal to or exceed 33% of the total qualified film production expenses of the project.

Depending on the amount of qualified film production expenses involved in each submitted project, a film-lease production company is able to capture additional Above-the-line(ATL) wage and salary expenses in its award calculation as follows:

- For a film-lease production company that incurs less than $50 million in qualified film production expenses, they can include up to $15 million in ATL wage and salary expenses as qualified per project.

- For a film-lease production company that incurs $50 million or more in qualified film production expenses, can include up to $60 million in ATL wage and salary expenses as qualified per project.

If a New Jersey film-lease partner facility has received a temporary or final certificate of occupancy, a film production company shall satisfy one of the following two criteria:

- The film production company shoots at least 50 percent of the total principal photography shoot days of the project within New Jersey at the New Jersey film-lease partner facility; or

- The qualified film production expenses of the project for all services performed and goods used or consumed at the New Jersey film-lease partner facility and payments made for the use of the New Jersey film-lease partner facility equal or exceed 33 percent of the total qualified film production expenses of the project.

If a New Jersey film-lease partner facility has not yet received a temporary or final certificate of occupancy, a film production company shall have entered a lease or sublease with the owner or developer of a New Jersey film-lease partner facility, which lease, or sublease is for not less than three years of occupancy of the New Jersey film-lease partner facility and includes at least 36,000 square feet of soundstage space. The film production company shall have executed a contract with the owner or developer of the New Jersey film-lease partner facility to provide production services for films produced by the film production company in New Jersey prior to the New Jersey film-lease partner facility’s receipt of a temporary or final certificate of occupancy.

Apply Here for Studio Partner or Film-Lease Partner Facility Designation

Studio Partner Film Tax Credit Online Application

Studio Partner Application Checklist

APPROVED DESIGNATIONS

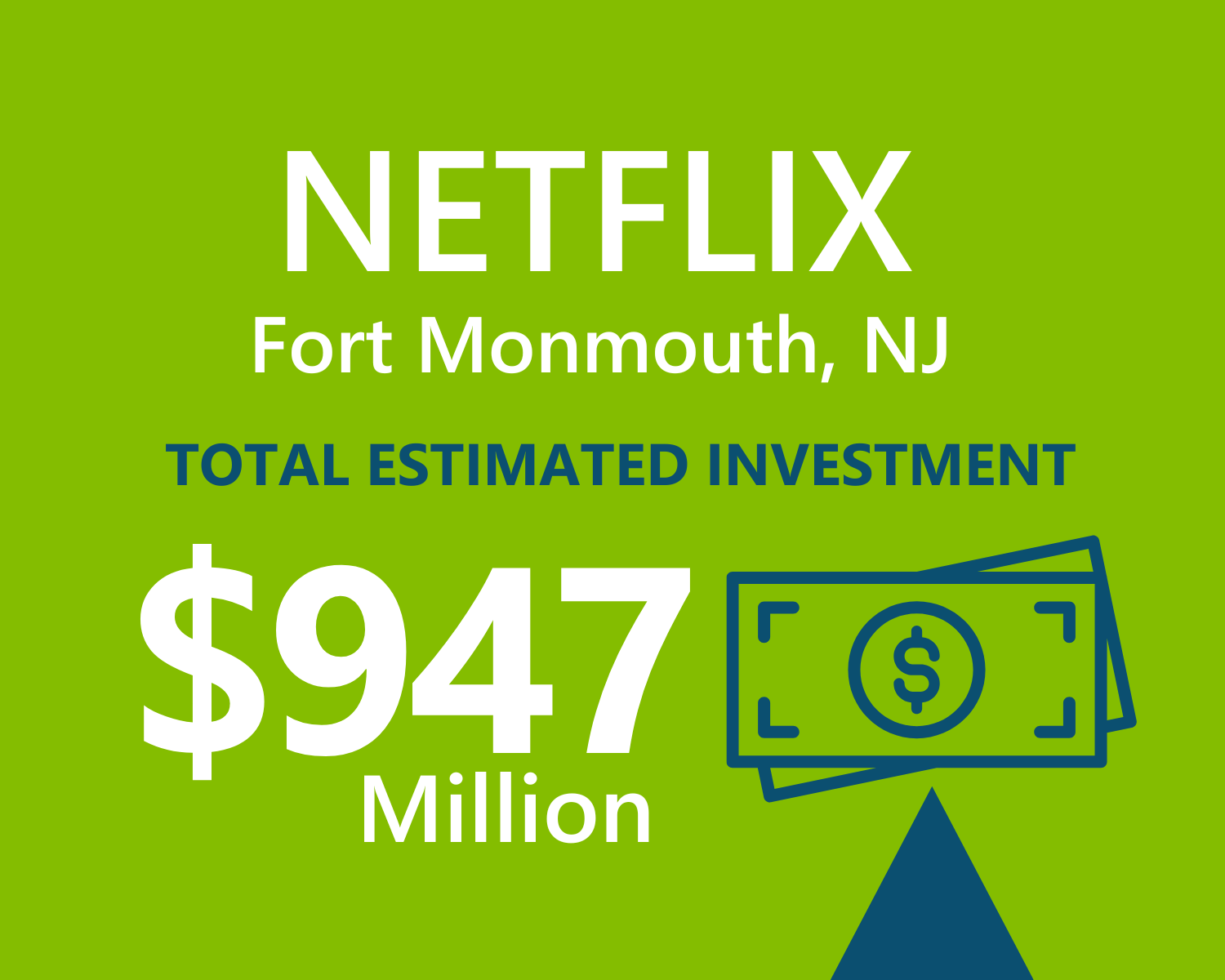

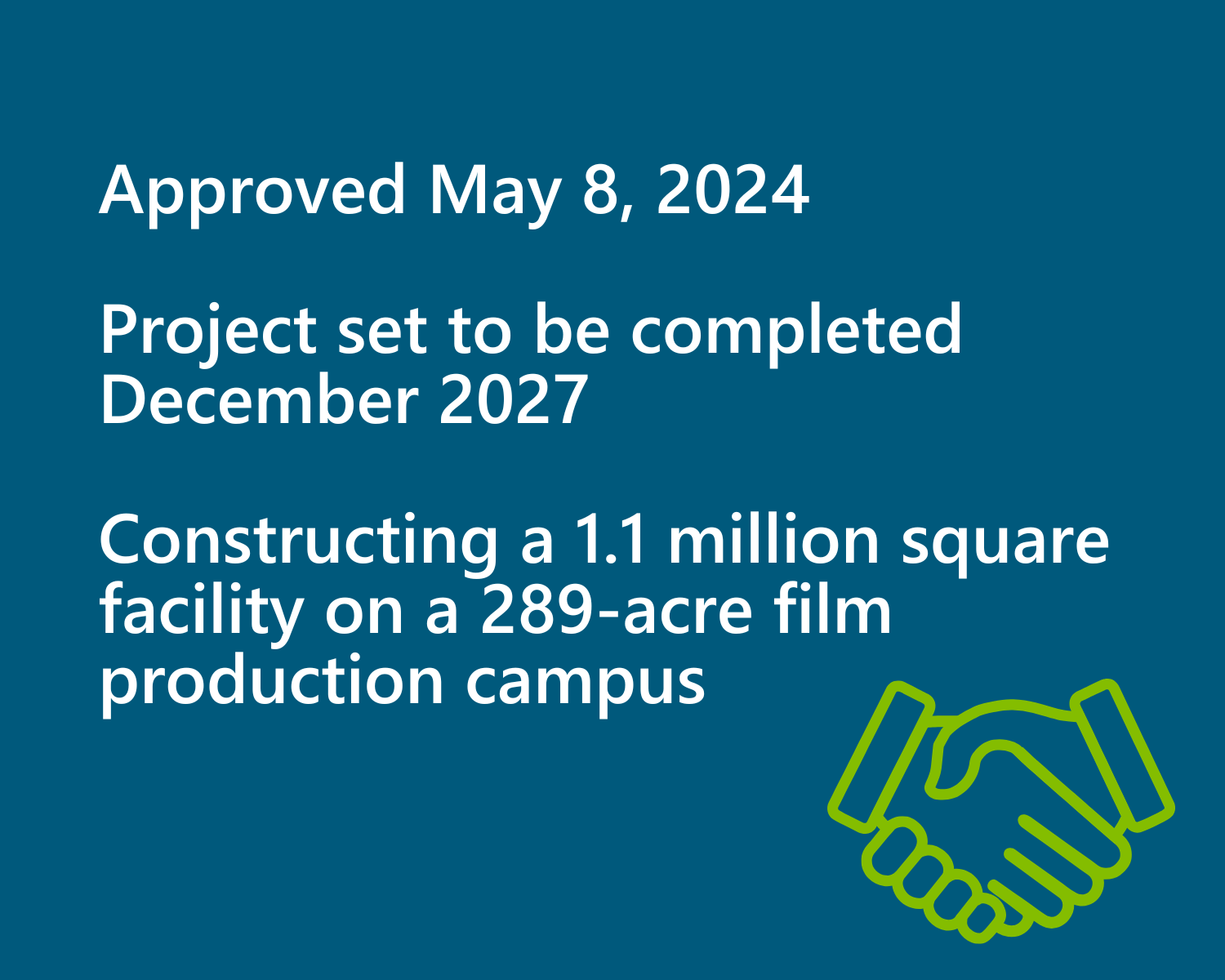

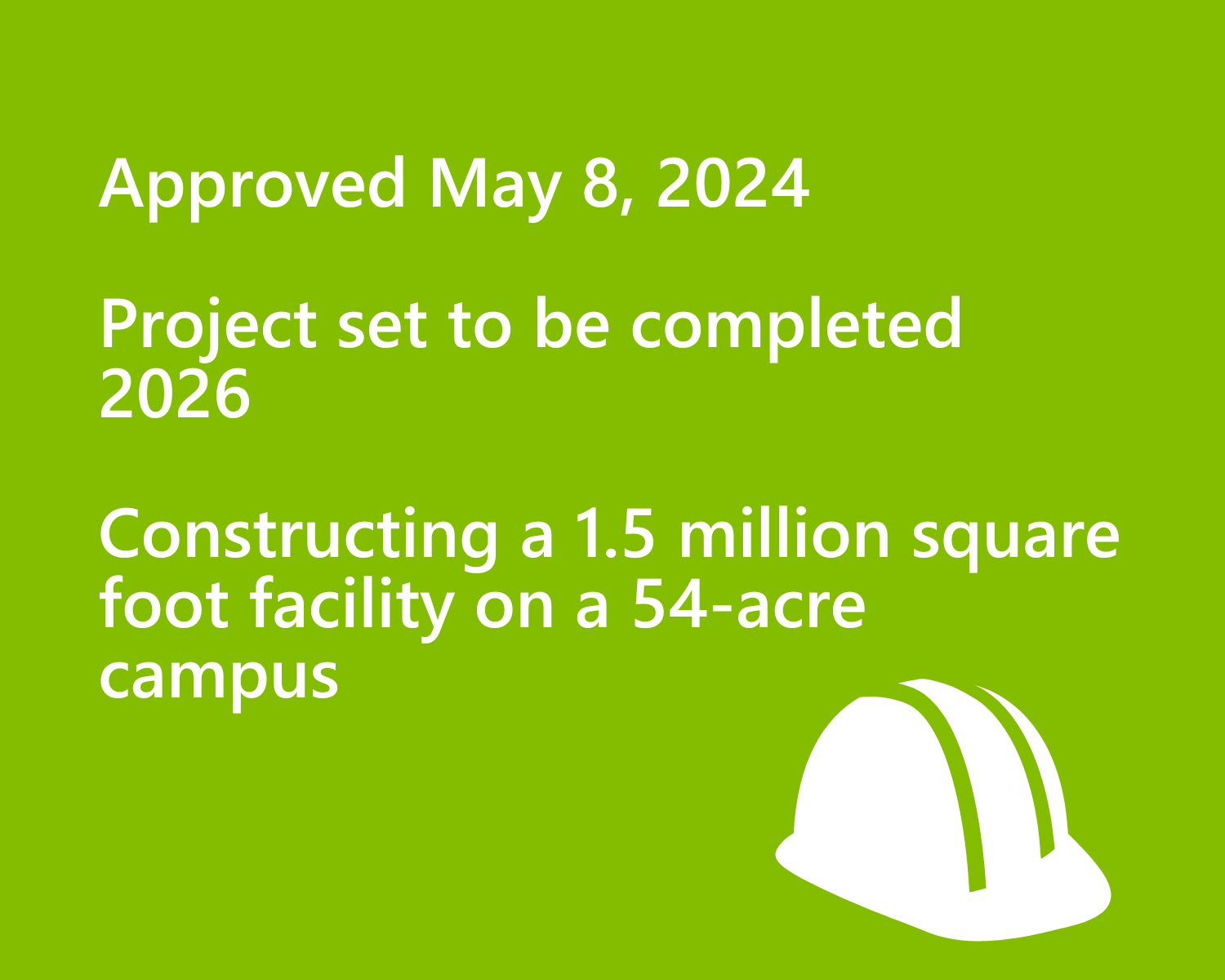

NETFLIX

(Studio Partner)

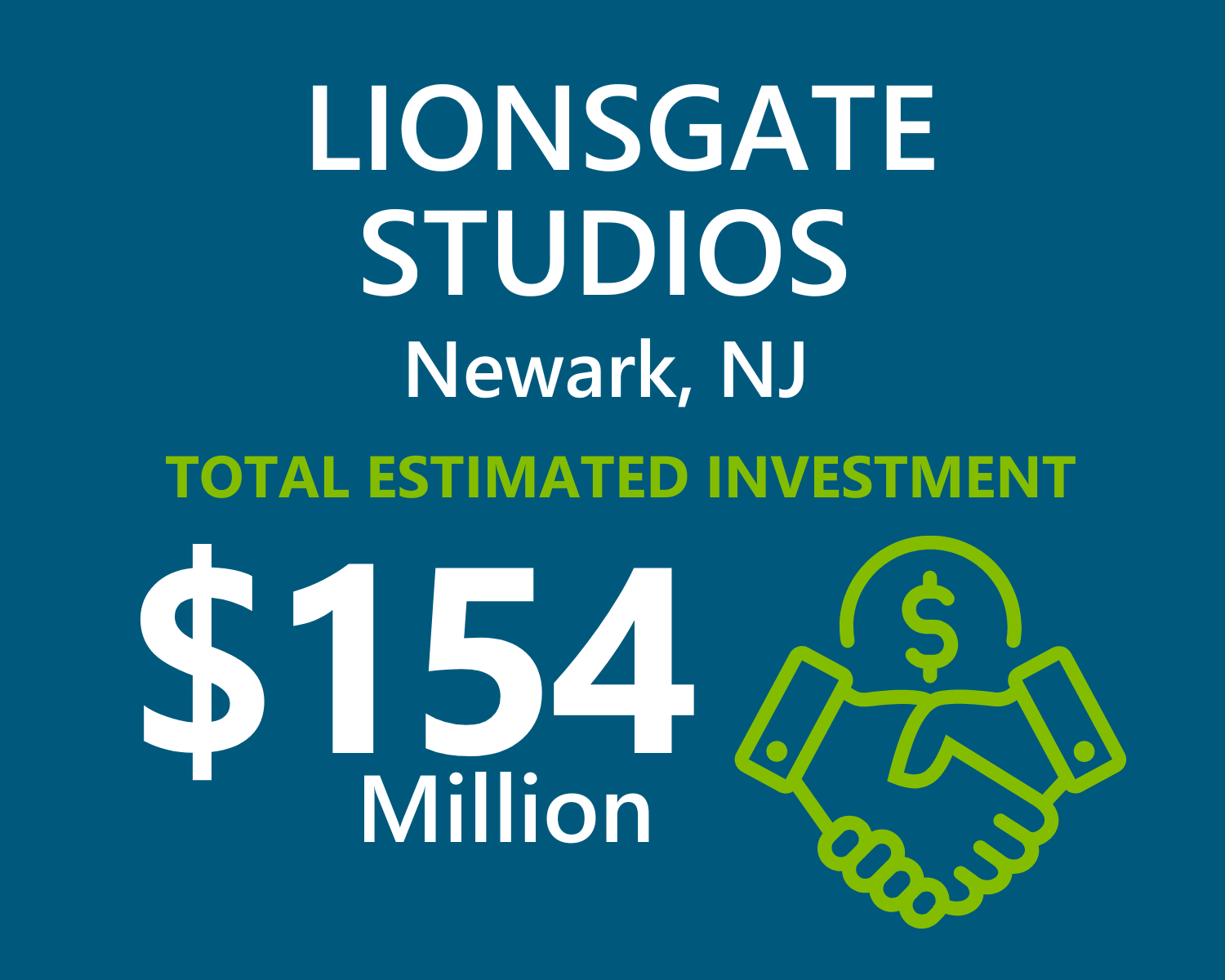

LIONSGATE

(Studio Partner)

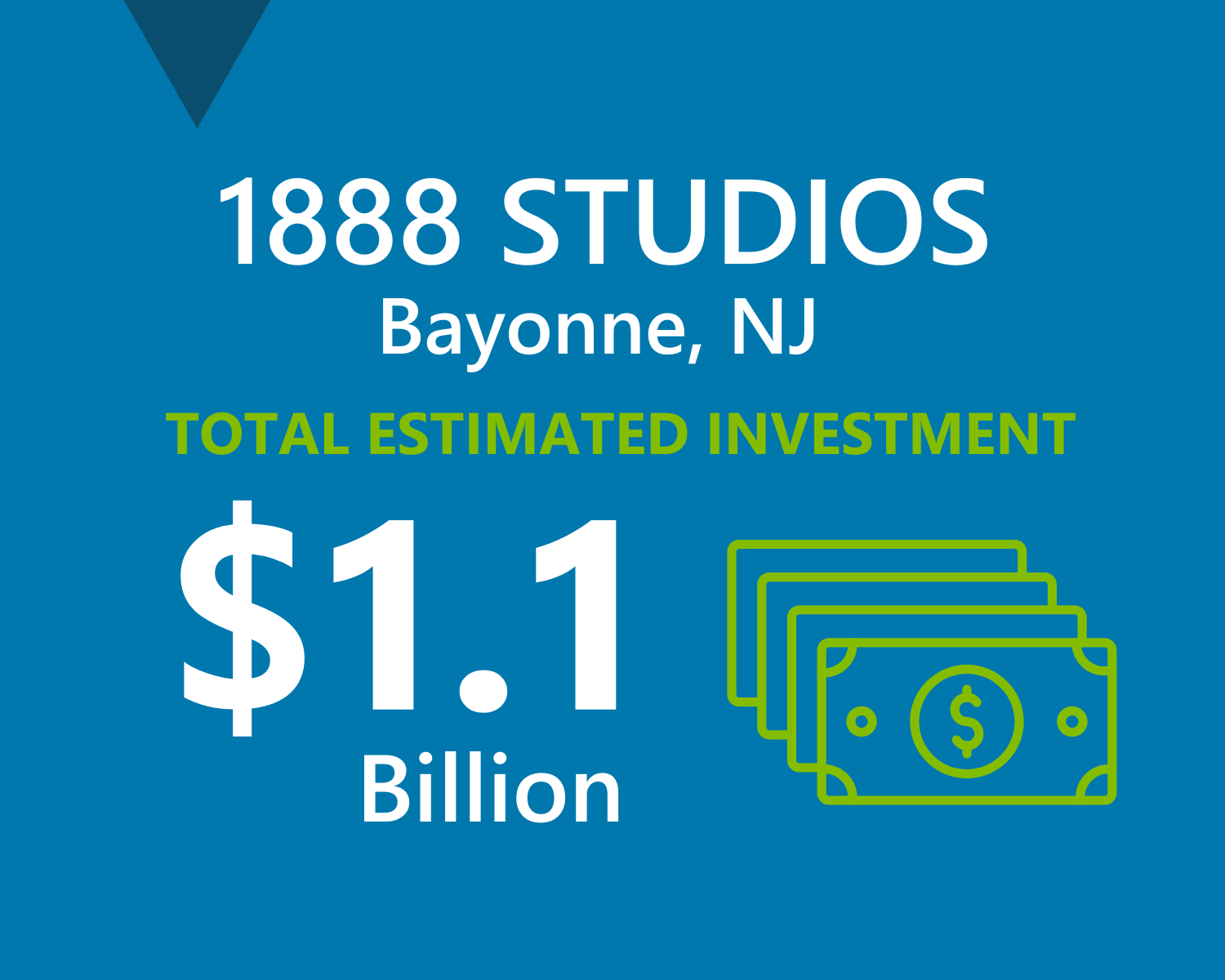

1888 Studios

(film-lease partner facility)

PROGRAM GUIDE

QUESTIONS

For questions regarding the New Jersey Film & Digital Media Tax Credit Program contact:

Sector Financing & Incentives

Sector Financing & Incentives

Sector Financing & Incentives

Or contact the New Jersey Motion Picture and Television Commission at (973) 648-6279